Hospitality Sector Must Act Now to Prepare for Pension Auto-Enrolment

Dublin, March 4th – Hotel and hospitality businesses across Ireland are on the clock as the country’s new Auto-Enrolment Retirement Savings Scheme comes into force on 30 September 2025. The scheme introduces mandatory employer contributions and new administrative requirements, marking a significant shift for the sector—particularly for businesses that have never had to manage workplace pensions before.

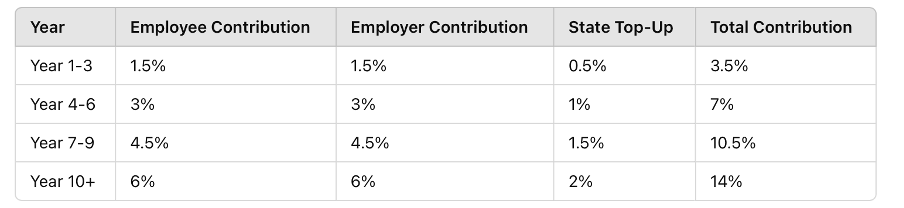

The hospitality sector, already grappling with tight margins and staffing challenges, now faces additional payroll costs starting at 1.5% of gross salaries (capped at €80,000 per employee) in year one, rising to 6% within a decade.

Pension Awareness on the Rise

The move towards auto-enrolment comes as retirement planning awareness grows in Ireland. According to the Central Statistics Office (CSO), 66% of workers aged 20-69 now have some form of private pension, up from 65% in 2020 and just 60% in 2019. While the average pension pot currently stands at €111,000, many workers—particularly those in lower-paid and transient industries like hospitality—still lack retirement savings.

Contact David Maguire, Assistant Tax Manager at HLB Ireland, has extensive experience working with hospitality and hotel businesses on this issue and urges owners to start preparing now.

"For many hospitality businesses, this is the first time they’ll need to manage pension contributions, and the financial and administrative impact cannot be underestimated. While contributions will be phased in gradually, costs will more than quadruple within a decade. If owners don’t plan ahead, they risk major cash flow and compliance challenges."

The busiest period for hospitality businesses begins around St. Patrick’s Day, meaning employers who delay preparations will be too busy later to ensure a smooth transition.

"From March onwards, hotels, restaurants, and pubs are completely focused on operations. If businesses don’t get their systems in place now, they’ll be scrambling to comply just as their peak season winds down—and that’s a risk they can’t afford to take," David warns.

New Costs & Responsibilities for Hospitality Employers

Auto-enrolment will apply to employees aged 23 to 60 who earn €20,000 or more per year and are not already in a pension scheme. Employers must match employee contributions, while the State will provide a top-up of €1 for every €3 paid by staff.

The cost burden will increase over time, with contributions rising as follows:

David stresses that while the phased approach gives businesses time, ignoring the issue could lead to financial strain later:

"A hotel, restaurant, or pub with 50 staff could be looking at an extra five or six-figure payroll cost within a decade. Budgeting for this now is essential—otherwise, businesses will be caught off guard when contributions ramp up."

Why Hospitality Businesses Need to Act Now

Auto-enrolment comes with a range of compliance and operational challenges, particularly for businesses with high staff turnover, seasonal workers, and multiple payroll systems. Key concerns include:

- Payroll system readiness – Employers must ensure their systems can handle automatic enrolment, opt-ins, and opt-outs.

- Staff communication – Employees need to be informed about their pension entitlements, contribution rates, and the opt-out process.

- Cash flow management – Rising employer contributions must be factored into long-term financial planning.

- Ongoing compliance – Employers who fail to make required contributions could face penalties and backdated repayments.

David warns that business owners who wait until late 2025 to address these challenges will be under extreme pressure:

"Payroll teams will need time to adjust, and staff will have questions about their rights. Sorting this out during peak trading months will be impossible—owners need to get ahead of it now."

Outsource the Hassle – Simplify Auto-Enrolment for Your Business

For many in the hospitality sector, outsourcing pension administration is the most efficient way to ensure compliance while minimising disruption. HLB Ireland has already helped hotels, restaurants, and pubs nationwide prepare for auto-enrolment—providing expert guidance, payroll system integration, and outsourced administration solutions.

"We understand that business owners in this sector don’t have time to deal with complex pension regulations," says David. "That’s why we’re working with hospitality businesses now to set up seamless, outsourced solutions that take the hassle out of auto-enrolment."

What Should Business Owners Do Now?

- Assess your workforce – Identify who will be automatically enrolled.

- Upgrade payroll systems – Ensure compliance with auto-enrolment requirements.

- Budget for rising costs – Plan for increasing employer contributions over time.

- Educate staff – Help employees understand their pension entitlements.

- Explore outsourced solutions – Reduce admin headaches by working with pension and payroll specialists.

Contact David to Discuss Your Options

Contact David Maguire and the HLB Ireland team are already working with hospitality businesses across Ireland to help them navigate auto-enrolment efficiently.

"Don’t leave this until the last minute—taking action now will save you time, money, and stress later," says David. "If you need help, reach out, and let’s find a solution that works for your business."

ENDS

For media enquiries, please contact:

Martha O'Connor

T: (0)1 291 5265